In the ever-evolving world of technology, few innovations have garnered as much attention as blockchain technology. From revolutionizing financial systems to disrupting industries such as healthcare, supply chain, and real estate, blockchain has proven to be much more than a passing trend. It represents a paradigm shift in how we think about data integrity, trust, and decentralized systems. But to truly appreciate the transformative power of blockchain, it’s not enough to merely understand its surface-level applications—you must delve into its core.

This blog post is designed to take you on a journey from the ground up. We’re going to build a fully functional blockchain from scratch, and we’ll be doing it in C++, one of the most powerful and efficient programming languages available. By the end of this guide, you will not only have a working blockchain but also a deep understanding of the fundamental concepts that make blockchain technology so robust and secure.

Table of Contents

Why Build a Blockchain From Scratch?

You might be wondering: why go through the trouble of building a blockchain from scratch when there are countless frameworks and libraries available? The answer lies in the learning process itself.

- Deep Understanding:

Blockchain is a complex technology that combines data structures, cryptography, distributed systems, and consensus mechanisms. Building one from the ground up forces you to understand how each of these components works and how they interact. - Hands-On Experience:

There’s no substitute for hands-on experience when it comes to learning. By implementing each aspect of a blockchain, you’ll gain practical skills in problem-solving, debugging, and optimization—skills that are invaluable for any software engineer. - Customizability:

Off-the-shelf blockchain frameworks are great, but they often come with limitations. By building your own, you can customize it to suit specific needs, whether it’s for educational purposes, a proof of concept, or even the foundation of a new project. - Mastering C++:

C++ is a language known for its speed, efficiency, and control over system resources. These attributes make it an ideal choice for building a blockchain, which requires handling large volumes of data and performing computationally intensive tasks like cryptographic hashing.

You may like to read my article on: The best JavaScript Functional Programming books.

What You Will Learn

This tutorial will guide you through every step of building a blockchain, starting with the basics and gradually moving towards more advanced topics. Here’s a preview of what you’ll learn:

- Blockchain Fundamentals: What is a blockchain? How does it work? Why is it secure?

- Designing Data Structures: Creating classes for blocks, transactions, and the blockchain itself.

- Implementing Cryptography: Using hashing algorithms and digital signatures to secure data.

- Building a Peer-to-Peer Network: Connecting multiple nodes to form a decentralized network.

- Consensus Mechanisms: Ensuring all nodes agree on the state of the blockchain.

- Testing and Deployment: Running your blockchain locally and deploying it to the cloud.

By the end of this tutorial, you will have a working blockchain implemented in C++ and a solid understanding of the concepts that underpin blockchain technology.

The Importance of Blockchain Technology

Before we dive into the technical details, it’s worth taking a moment to appreciate why blockchain technology is so important. At its core, a blockchain is a distributed ledger—a database that is shared across multiple nodes or computers. This simple concept has far-reaching implications.

- Decentralization:

Traditional databases are centralized, meaning they are controlled by a single entity. Blockchain, on the other hand, is decentralized. No single entity has control over the entire network, making it resistant to censorship and single points of failure. - Immutability:

Once data is added to a blockchain, it cannot be altered or deleted. This immutability ensures the integrity of the data and makes the blockchain an ideal solution for applications that require a high level of trust. - Transparency:

Every transaction on a public blockchain is visible to all participants. This transparency fosters trust and accountability, which is why blockchain is often used in industries like finance and supply chain management. - Security:

Blockchain uses advanced cryptographic techniques to secure data. Each block is linked to the previous one using a cryptographic hash, making it virtually impossible to alter data without being detected.

These characteristics make blockchain a powerful tool for solving real-world problems, and by the end of this tutorial, you’ll have the knowledge and skills to build one yourself.

Overview of the Tutorial

Here’s a brief overview of the steps we’ll take to build our blockchain:

- Blockchain Fundamentals: We’ll start by understanding what a blockchain is and how it works. We’ll also cover key concepts like cryptographic hashing and proof of work.

- Designing the Blockchain: Next, we’ll design the data structures for our blockchain, including classes for blocks, transactions, and the blockchain itself.

- Implementing Core Functions: We’ll implement the core functions that make a blockchain work, such as calculating hashes, validating blocks, and mining new blocks.

- Building a Peer-to-Peer Network: Once we have a basic blockchain, we’ll build a peer-to-peer network that allows multiple nodes to communicate and synchronize with each other.

- Testing and Deployment: Finally, we’ll test our blockchain to ensure it works as expected and deploy it to a cloud platform.

Each section will be detailed, with code examples, explanations, and practical tips. Whether you’re a seasoned developer or a curious beginner, this tutorial will provide you with a comprehensive guide to building a blockchain from scratch using C++.

Getting Started

Before we begin coding, make sure you have the following tools and libraries installed on your system:

- IDE: Visual Studio Code, CLion, or your preferred C++ development environment.

- Compiler: GCC, Clang, or MSVC.

- Build System: CMake for build automation.

- Libraries:

- OpenSSL for cryptographic functions.

- Boost for networking and other utilities.

Now that we’ve covered the basics, it’s time to dive into the first section: Blockchain Fundamentals. In this section, we’ll explore the core concepts of blockchain technology and lay the foundation for building our own blockchain in C++.

Section 1: Blockchain Fundamentals

Understanding the fundamentals of blockchain is critical before we start writing any code. In this section, we’ll dive deep into the core concepts that form the backbone of blockchain technology. By the end, you’ll have a solid grasp of how blockchains work and why they are considered secure, immutable, and decentralized.

1.1 What Is a Blockchain?

At its most basic level, a blockchain is a distributed ledger—a digital database that records transactions across a network of computers. Unlike traditional databases, which are typically managed by a single entity, blockchains are decentralized and operate on a peer-to-peer (P2P) network.

Key Characteristics of a Blockchain

- Decentralization:

In a blockchain network, there is no central authority. Instead, control is distributed across multiple nodes (computers). Each node maintains a copy of the entire blockchain, ensuring that no single point of failure can compromise the network. - Immutability:

Once a block is added to the blockchain, it is nearly impossible to alter or delete its contents. This immutability is achieved through cryptographic hashing and consensus mechanisms. - Transparency:

Public blockchains, like Bitcoin and Ethereum, are open for anyone to inspect. Every transaction is visible to all participants, fostering trust and accountability. - Security:

Blockchain technology relies on advanced cryptographic techniques to secure data. Each block is linked to the previous one using a cryptographic hash, making it computationally infeasible to tamper with the data.

1.2 Anatomy of a Block

A blockchain is composed of a series of blocks that are linked together in a linear, chronological order. Each block contains several key components:

Block Structure

Let’s break down the structure of a block:

| Field | Description |

|---|---|

| Index | The position of the block in the blockchain (e.g., Block 0, Block 1, etc.). |

| Timestamp | The time when the block was created. |

| Previous Hash | The hash of the previous block in the chain. |

| Merkle Root | A cryptographic hash that represents all transactions in the block. |

| Nonce | A random number used in the proof-of-work (PoW) consensus mechanism. |

| Hash | The hash of the block’s contents, including the previous hash, timestamp, and transactions. |

| Transactions | A list of transactions included in the block. |

Example Block Structure in C++

Here’s a simplified C++ class for a block:

#include <iostream>

#include <vector>

#include <string>

#include <sstream>

#include <openssl/sha.h>

class Block {

public:

int index;

std::string timestamp;

std::string previousHash;

std::string hash;

std::vector<std::string> transactions;

int nonce;

Block(int idx, std::string prevHash, std::vector<std::string> txns, std::string time)

: index(idx), previousHash(prevHash), transactions(txns), timestamp(time), nonce(0) {

hash = calculateHash();

}

std::string calculateHash() const {

std::stringstream ss;

ss << index << timestamp << previousHash << nonce;

for (const auto& txn : transactions) {

ss << txn;

}

return sha256(ss.str());

}

private:

std::string sha256(const std::string& data) const {

unsigned char hash[SHA256_DIGEST_LENGTH];

SHA256((unsigned char*)data.c_str(), data.size(), hash);

std::stringstream ss;

for (int i = 0; i < SHA256_DIGEST_LENGTH; i++) {

ss << std::hex << std::setw(2) << std::setfill('0') << (int)hash[i];

}

return ss.str();

}

};

Code language: C++ (cpp)1.3 What Is a Blockchain?

A blockchain is essentially a linked list of blocks, where each block contains a reference (hash) to the previous block. This linking of blocks creates a chain, hence the name “blockchain.”

How Blocks Are Linked

- Each block contains a field called

previousHash, which stores the hash of the preceding block. - If any block in the chain is altered, its hash will change, invalidating all subsequent blocks.

- This ensures the integrity of the entire chain.

Example of Linking Blocks

Consider a simple chain of three blocks:

- Genesis Block (Block 0):

- Index: 0

- Previous Hash:

0(since it’s the first block) - Hash:

abc123

- Block 1:

- Index: 1

- Previous Hash:

abc123 - Hash:

def456

- Block 2:

- Index: 2

- Previous Hash:

def456 - Hash:

ghi789

If someone tries to modify Block 1, its hash will change, breaking the chain’s continuity and rendering Block 2 invalid.

1.4 Consensus Mechanisms

One of the most critical aspects of a blockchain is achieving consensus—ensuring that all nodes in the network agree on the current state of the blockchain.

Popular Consensus Mechanisms

- Proof of Work (PoW):

- Used by Bitcoin.

- Requires miners to solve complex mathematical puzzles to add a new block.

- Ensures security but is computationally expensive.

- Proof of Stake (PoS):

- Validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake.”

- More energy-efficient than PoW.

- Delegated Proof of Stake (DPoS):

- Users vote for delegates who validate transactions and add blocks.

- Faster and more scalable than traditional PoS.

- Practical Byzantine Fault Tolerance (PBFT):

- Designed for permissioned blockchains.

- Achieves consensus by requiring a majority of nodes to agree on the next block.

1.5 Security Features of Blockchain

Blockchain technology is often praised for its security. Let’s explore the mechanisms that make it so secure:

- Cryptographic Hashing:

- Ensures data integrity.

- Even a small change in the input will result in a completely different hash.

- Decentralization:

- No single point of failure.

- Attacking a decentralized network requires compromising a majority of nodes.

- Public Key Cryptography:

- Transactions are signed with a private key and verified with a public key.

- Ensures authenticity and non-repudiation.

- Immutability:

- Once a block is added to the blockchain, it cannot be altered.

- Makes blockchain an ideal solution for applications that require a high level of trust.

Section 2: Designing the Blockchain

In this section, we will design the foundational data structures and components required to build our blockchain. A well-structured blockchain requires careful planning of how blocks, transactions, and the chain itself interact. We will leverage the power and efficiency of C++ to implement these structures.

By the end of this section, you will have:

- A

Transactionclass to represent individual transactions. - A

Blockclass to encapsulate each block’s data. - A

Blockchainclass to manage the chain of blocks. - Functions to handle hashing, data validation, and mining.

2.1 Designing the Transaction Class

A blockchain is fundamentally a ledger of transactions. Every block in the blockchain contains a list of transactions, which may represent anything from financial transfers to data changes. Let’s start by defining a simple Transaction class in C++.

What Is a Transaction?

In the context of a blockchain, a transaction is a unit of data that records a transfer of value or information. Each transaction typically contains:

- Sender: The public address of the entity initiating the transaction.

- Recipient: The public address of the entity receiving the value.

- Amount: The value being transferred (for financial blockchains).

- Timestamp: The time when the transaction was created.

- Signature: A digital signature to verify the authenticity of the transaction.

Transaction Class Definition

Here’s a basic implementation of a Transaction class in C++:

#include <iostream>

#include <string>

#include <sstream>

#include <ctime>

class Transaction {

public:

std::string sender;

std::string recipient;

double amount;

std::string timestamp;

std::string signature;

// Constructor

Transaction(std::string senderAddress, std::string recipientAddress, double transferAmount)

: sender(senderAddress), recipient(recipientAddress), amount(transferAmount) {

timestamp = getCurrentTime();

signature = "";

}

// Method to generate a string representation of the transaction

std::string toString() const {

std::stringstream ss;

ss << sender << recipient << amount << timestamp;

return ss.str();

}

// Method to sign the transaction (for simplicity, a placeholder)

void signTransaction(const std::string& privateKey) {

// TODO: Implement actual cryptographic signing using privateKey

signature = "signed_with_" + privateKey;

}

// Method to verify the transaction signature

bool isValid() const {

if (sender.empty() || recipient.empty() || signature.empty()) {

return false;

}

// TODO: Implement actual signature verification

return true;

}

private:

// Helper function to get the current timestamp

std::string getCurrentTime() const {

std::time_t now = std::time(nullptr);

char buf[80];

std::strftime(buf, sizeof(buf), "%Y-%m-%d %H:%M:%S", std::localtime(&now));

return std::string(buf);

}

};

Code language: C++ (cpp)Explanation

- Constructor: Initializes a new transaction with the sender, recipient, and amount. The timestamp is automatically generated.

- toString(): Returns a string representation of the transaction, which is useful for hashing and verification.

- signTransaction(): Signs the transaction using a private key (we’ll implement real cryptographic signing later).

- isValid(): Checks if the transaction is valid by verifying its signature.

2.2 Designing the Block Class

A blockchain is composed of a series of blocks, each of which contains a list of transactions. Let’s define a Block class to represent each block in the chain.

Block Structure

Each block will contain the following fields:

- Index: The position of the block in the blockchain.

- Timestamp: The time when the block was created.

- Transactions: A list of transactions included in the block.

- Previous Hash: The hash of the preceding block.

- Nonce: A random number used in the proof-of-work (PoW) algorithm.

- Hash: The hash of the block’s contents.

Block Class Definition

Here’s a C++ implementation of a Block class:

#include <iostream>

#include <vector>

#include <string>

#include <sstream>

#include <iomanip>

#include <openssl/sha.h>

class Block {

public:

int index;

std::string timestamp;

std::string previousHash;

std::string hash;

std::vector<Transaction> transactions;

int nonce;

// Constructor

Block(int idx, std::string prevHash, std::vector<Transaction> txns)

: index(idx), previousHash(prevHash), transactions(txns), nonce(0) {

timestamp = getCurrentTime();

hash = calculateHash();

}

// Method to calculate the hash of the block

std::string calculateHash() const {

std::stringstream ss;

ss << index << timestamp << previousHash << nonce;

for (const auto& txn : transactions) {

ss << txn.toString();

}

return sha256(ss.str());

}

// Proof of Work: Simple mining function

void mineBlock(int difficulty) {

std::string target(difficulty, '0');

while (hash.substr(0, difficulty) != target) {

nonce++;

hash = calculateHash();

}

std::cout << "Block mined: " << hash << std::endl;

}

private:

// Helper function to calculate SHA-256 hash

std::string sha256(const std::string& data) const {

unsigned char hash[SHA256_DIGEST_LENGTH];

SHA256((unsigned char*)data.c_str(), data.size(), hash);

std::stringstream ss;

for (int i = 0; i < SHA256_DIGEST_LENGTH; i++) {

ss << std::hex << std::setw(2) << std::setfill('0') << (int)hash[i];

}

return ss.str();

}

// Helper function to get the current timestamp

std::string getCurrentTime() const {

std::time_t now = std::time(nullptr);

char buf[80];

std::strftime(buf, sizeof(buf), "%Y-%m-%d %H:%M:%S", std::localtime(&now));

return std::string(buf);

}

};

Code language: C++ (cpp)Explanation

- Constructor: Initializes the block with an index, previous hash, and a list of transactions. The timestamp is automatically generated, and the block’s hash is calculated.

- calculateHash(): Calculates the block’s hash based on its contents, including the list of transactions.

- mineBlock(): A simple proof-of-work algorithm that repeatedly calculates the hash until it matches the required difficulty (i.e., a certain number of leading zeros).

- sha256(): Uses the OpenSSL library to compute the SHA-256 hash of a given string.

2.3 Designing the Blockchain Class

Now that we have defined the fundamental building blocks of our blockchain—the Transaction and Block classes—we can proceed to design the Blockchain class. This class will serve as the heart of our blockchain, responsible for:

- Storing and managing the chain of blocks.

- Adding new blocks to the chain.

- Validating the integrity of the blockchain.

- Implementing a simple consensus mechanism.

Let’s dive in and build this essential component step by step.

Blockchain Class Overview

The Blockchain class will be responsible for the following tasks:

- Initialization:

The blockchain should start with a genesis block, which is the first block in the chain. - Adding Blocks:

We need a method to add new blocks to the chain. - Chain Validation:

A method to verify the integrity of the blockchain, ensuring no block has been tampered with. - Mining:

A simple mining function that performs proof-of-work (PoW) to add new blocks.

Blockchain Class Definition

Here’s a C++ implementation of the Blockchain class:

#include <iostream>

#include <vector>

class Blockchain {

public:

std::vector<Block> chain;

int difficulty;

// Constructor: Initialize the blockchain with the genesis block

Blockchain() {

chain.push_back(createGenesisBlock());

difficulty = 4; // Adjust difficulty as needed

}

// Method to add a new block to the blockchain

void addBlock(const Block& newBlock) {

Block blockToAdd = newBlock;

blockToAdd.previousHash = getLatestBlock().hash;

blockToAdd.mineBlock(difficulty);

chain.push_back(blockToAdd);

}

// Method to validate the integrity of the blockchain

bool isChainValid() const {

for (size_t i = 1; i < chain.size(); i++) {

const Block& currentBlock = chain[i];

const Block& previousBlock = chain[i - 1];

// Check if the current block's hash is correct

if (currentBlock.hash != currentBlock.calculateHash()) {

return false;

}

// Check if the current block's previous hash matches the hash of the previous block

if (currentBlock.previousHash != previousBlock.hash) {

return false;

}

}

return true;

}

// Method to print the blockchain

void printBlockchain() const {

for (const auto& block : chain) {

std::cout << "Block #" << block.index << std::endl;

std::cout << "Timestamp: " << block.timestamp << std::endl;

std::cout << "Previous Hash: " << block.previousHash << std::endl;

std::cout << "Hash: " << block.hash << std::endl;

std::cout << "Nonce: " << block.nonce << std::endl;

std::cout << "Transactions: " << std::endl;

for (const auto& txn : block.transactions) {

std::cout << "\t" << txn.sender << " -> " << txn.recipient << " : " << txn.amount << std::endl;

}

std::cout << "------------------------------------" << std::endl;

}

}

private:

// Method to create the genesis block

Block createGenesisBlock() {

std::vector<Transaction> genesisTransactions = {Transaction("0", "0", 0)};

return Block(0, "0", genesisTransactions);

}

// Method to get the latest block in the chain

Block getLatestBlock() const {

return chain.back();

}

};

Code language: C++ (cpp)Explanation

- Constructor:

The blockchain is initialized with a genesis block, which has no previous block. The difficulty level for mining is set here. - addBlock():

This method creates a new block, sets its previous hash to the hash of the latest block, mines it using proof-of-work, and then adds it to the chain. - isChainValid():

This method verifies the integrity of the blockchain by checking:- If the hash of each block matches its calculated hash.

- If the

previousHashfield of each block matches the hash of the preceding block.

- printBlockchain():

This method prints the details of all blocks in the chain, providing a clear view of the blockchain’s contents. - createGenesisBlock():

This private method creates and returns the genesis block. - getLatestBlock():

Returns the most recent block in the chain, which is used when adding new blocks.

Mining a New Block

Let’s test our blockchain by mining a few blocks and displaying the contents.

Main Function Example

Here’s a simple main() function to demonstrate the creation and use of the Blockchain class:

int main() {

// Create a blockchain

Blockchain myBlockchain;

// Add a few blocks with transactions

std::vector<Transaction> transactions1 = {

Transaction("Alice", "Bob", 50.0),

Transaction("Bob", "Charlie", 25.0)

};

myBlockchain.addBlock(Block(1, myBlockchain.chain.back().hash, transactions1));

std::vector<Transaction> transactions2 = {

Transaction("Charlie", "Alice", 10.0),

Transaction("Alice", "David", 15.0)

};

myBlockchain.addBlock(Block(2, myBlockchain.chain.back().hash, transactions2));

// Print the blockchain

std::cout << "Blockchain contents:" << std::endl;

myBlockchain.printBlockchain();

// Validate the blockchain

if (myBlockchain.isChainValid()) {

std::cout << "Blockchain is valid." << std::endl;

} else {

std::cout << "Blockchain is invalid!" << std::endl;

}

return 0;

}

Code language: C++ (cpp)Expected Output

The program will print the details of all blocks in the blockchain, including:

- The index, timestamp, previous hash, hash, and nonce of each block.

- The transactions included in each block.

Finally, it will validate the blockchain and display whether it is valid or not.

Enhancements to the Blockchain

While the blockchain we’ve built is functional, it’s quite basic. Here are some enhancements we can implement in future sections:

- Digital Signatures:

Implement actual cryptographic signing and verification for transactions using public-private key pairs. - Networking:

Create a peer-to-peer (P2P) network to allow multiple nodes to synchronize their blockchains. - Consensus Mechanism:

Implement more sophisticated consensus mechanisms, such as Proof of Stake (PoS) or Delegated Proof of Stake (DPoS). - Data Persistence:

Store the blockchain data in a file or database for persistence across program runs. - Smart Contracts:

Add support for executing smart contracts within blocks.

Section 3: Implementing Proof of Work (PoW)

In this section, we will implement Proof of Work (PoW), the cornerstone of blockchain security. PoW is a consensus mechanism that ensures all nodes in a decentralized network agree on the same version of the blockchain. It provides a means to validate new transactions and create new blocks by solving computational puzzles.

We will explore:

- What PoW is and why it’s important.

- The mathematics behind PoW.

- How to implement PoW in our blockchain.

- Enhancing mining difficulty.

- Assessing PoW’s strengths and limitations.

3.1 Understanding Proof of Work

What Is Proof of Work?

Proof of Work is a consensus algorithm used by many blockchains (most notably Bitcoin) to achieve distributed consensus. It requires participants (miners) to solve a complex mathematical problem to add a new block to the blockchain.

The problem must satisfy two main properties:

- Difficulty: The problem should be computationally hard to solve.

- Verifiability: The solution should be easy to verify by others.

Why Is Proof of Work Important?

PoW serves several key purposes:

- Security: It makes it computationally infeasible for malicious actors to alter past blocks, as they would need to redo the PoW for all subsequent blocks.

- Decentralization: Ensures no single entity controls the blockchain, as mining power is distributed.

- Sybil Resistance: Prevents attackers from overwhelming the network with multiple identities, as each identity requires significant computational effort.

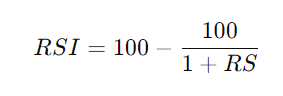

3.2 The Mathematics Behind Proof of Work

The core of PoW lies in hashing functions. In our case, we will use SHA-256 as our hashing algorithm. The mining process involves finding a value (called a nonce) that, when combined with the block’s data, produces a hash that satisfies a certain condition.

The condition typically requires the hash to start with a specific number of leading zeros, determined by the network’s difficulty level.

Hashing Recap

A hash function takes an input and produces a fixed-size string, which appears random. Key properties of a cryptographic hash function include:

- Deterministic: The same input always produces the same output.

- Fast Computation: Hashing should be quick.

- Preimage Resistance: Given a hash, it’s computationally infeasible to find the original input.

- Avalanche Effect: A small change in input drastically changes the output.

Difficulty Target

The difficulty target is a numeric value that defines how hard it is to mine a block. In practical terms:

- A lower difficulty target means it’s easier to mine blocks (e.g., fewer leading zeros).

- A higher difficulty target makes mining harder.

The formula for mining success:

Hash(Block Data + Nonce)≤Difficulty Target\text{Hash(Block Data + Nonce)} \leq \text{Difficulty Target}

3.3 Implementing Proof of Work

Let’s integrate PoW into our Block class by enhancing its mineBlock method.

Mining Logic

Here’s the updated mineBlock implementation:

void Block::mineBlock(int difficulty) {

std::string target(difficulty, '0'); // Create a target string with 'difficulty' leading zeros

while (hash.substr(0, difficulty) != target) {

nonce++; // Increment nonce to try a new hash

hash = calculateHash(); // Recalculate the hash with the new nonce

}

std::cout << "Block mined: " << hash << std::endl;

}

Code language: C++ (cpp)Explanation

- Target String: A string of leading zeros based on the difficulty.

- Mining Loop: Repeatedly increment the

nonceand recalculate the hash until the desired condition is met. - Efficiency: Higher difficulty increases the number of iterations required, making mining more resource-intensive.

Hash Calculation

We previously defined the calculateHash() function. It combines all block data and generates a SHA-256 hash:

std::string Block::calculateHash() const {

std::stringstream ss;

ss << index << timestamp << previousHash << nonce;

for (const auto& txn : transactions) {

ss << txn.toString();

}

return sha256(ss.str());

}

Code language: C++ (cpp)The nonce ensures each hash is unique even if the block data remains constant.

3.4 Adjusting Mining Difficulty

Dynamic Difficulty Adjustment

In real-world blockchains, the difficulty level is not static. To maintain a consistent block generation time (e.g., 10 minutes in Bitcoin), the difficulty is adjusted based on the network’s computational power.

Implementation Strategy:

- Calculate the time taken to mine the last

nblocks. - Adjust difficulty to keep block time close to the target time.

void Blockchain::adjustDifficulty() {

const int targetBlockTime = 600; // Target time in seconds (10 minutes)

const int adjustInterval = 10; // Adjust difficulty every 10 blocks

if (chain.size() % adjustInterval == 0) {

int elapsedTime = (chain.back().timestamp - chain[chain.size() - adjustInterval].timestamp);

if (elapsedTime < targetBlockTime * adjustInterval) {

difficulty++;

} else if (elapsedTime > targetBlockTime * adjustInterval) {

difficulty = std::max(1, difficulty - 1); // Ensure difficulty is at least 1

}

}

}

Code language: C++ (cpp)3.5 Testing the Proof of Work System

Here’s how we can test the PoW system:

int main() {

Blockchain myBlockchain;

// Create and mine some blocks

std::vector<Transaction> txns1 = { Transaction("Alice", "Bob", 50.0) };

myBlockchain.addBlock(Block(1, myBlockchain.chain.back().hash, txns1));

std::vector<Transaction> txns2 = { Transaction("Charlie", "Alice", 30.0) };

myBlockchain.addBlock(Block(2, myBlockchain.chain.back().hash, txns2));

myBlockchain.printBlockchain();

return 0;

}

Code language: C++ (cpp)Expected output:

- Details of each block, including the hash and nonce.

- Confirmation that blocks have been mined.

3.6 Strengths and Limitations of Proof of Work

Strengths

- Security: PoW requires a significant amount of computational work, making attacks costly.

- Decentralization: No single point of failure.

- Simplicity: PoW is relatively easy to implement and understand.

Limitations

- Energy Consumption: PoW consumes vast amounts of electricity, raising environmental concerns.

- Latency: High difficulty can lead to slow block times, reducing transaction throughput.

- Centralization Risk: Mining power may become concentrated in large mining pools.

3.7 Enhancing PoW for Real-World Use

To improve our blockchain:

- Consider implementing lightweight mining nodes for energy efficiency.

- Explore hybrid consensus mechanisms, such as Proof of Work + Proof of Stake.

Section 4: Securing Transactions and Data Integrity

In a blockchain, data security is paramount. Every transaction stored in a block needs to be tamper-proof, verifiable, and trustworthy. In this section, we will dive into the cryptographic techniques that secure transactions and ensure the integrity of the data in our blockchain. Specifically, we will cover:

- The importance of cryptographic security.

- Public-Key Cryptography (PKC) and how it works.

- Implementing digital signatures for transaction verification.

- Verifying data integrity with hash functions.

- Enhancing transaction security with multi-signature and time locks.

4.1 Why Cryptographic Security Is Essential in Blockchains

At its core, a blockchain is a decentralized ledger that is maintained by a network of nodes. Since anyone can potentially interact with the blockchain, the following security goals must be met:

Data Integrity

Data integrity ensures that the information stored in the blockchain remains unchanged. Even a single bit of tampered data would invalidate the cryptographic hash of a block, making tampering detectable.

Solution:

Hash functions such as SHA-256 are used to guarantee the integrity of each block. Each block’s hash is calculated based on its data and the hash of the previous block, forming a chain.

Authentication

Blockchain users need to trust that transactions are initiated by the rightful owners of the accounts involved. Authentication verifies the identity of the sender.

Solution:

Public-key cryptography (PKC) allows users to authenticate transactions by signing them with their private keys, and other nodes verify the signatures with the corresponding public keys.

Non-Repudiation

Non-repudiation ensures that once a transaction is signed and sent, the sender cannot deny having initiated it.

Solution:

Digital signatures offer non-repudiation, as only the owner of the private key could have generated the signature.

4.2 Introduction to Public-Key Cryptography (PKC)

Public-Key Cryptography is the foundation of blockchain security. It uses a pair of keys:

- A private key known only to the user.

- A public key that is shared openly.

How Public-Key Cryptography Works

- Key Generation:

A user generates a pair of keys: a public key and a private key. - Encryption and Decryption:

- Data encrypted with the public key can only be decrypted with the corresponding private key.

- Data encrypted with the private key can only be decrypted with the corresponding public key.

- Digital Signatures:

A digital signature is created by encrypting a hash of the data with the private key. Anyone can verify the signature by decrypting it with the public key.

Example: Signing and Verifying Transactions

Let’s implement public-key cryptography in C++ using the OpenSSL library to sign and verify transactions.

4.3 Implementing Digital Signatures in C++

To implement digital signatures, we’ll follow these steps:

- Generate a pair of cryptographic keys (public and private).

- Sign a transaction with the private key.

- Verify the signature with the public key.

Generating Cryptographic Keys

We can generate keys using OpenSSL commands or programmatically in C++. Here’s an example of how to generate an RSA key pair:

# Generate a private key

openssl genrsa -out private.pem 2048

# Extract the public key from the private key

openssl rsa -in private.pem -pubout -out public.pem

Code language: Bash (bash)Signing Transactions

We will create a method to sign a transaction using the private key. The transaction signature will be stored in the Transaction class.

Here’s an updated version of the Transaction class:

#include <openssl/pem.h>

#include <openssl/sha.h>

#include <openssl/rsa.h>

#include <iostream>

#include <fstream>

class Transaction {

public:

std::string sender;

std::string recipient;

double amount;

std::string signature;

Transaction(std::string sender, std::string recipient, double amount)

: sender(sender), recipient(recipient), amount(amount) {}

// Method to sign the transaction with a private key

void signTransaction(std::string privateKeyPath) {

std::string dataToSign = sender + recipient + std::to_string(amount);

// Generate SHA256 hash of the data

unsigned char hash[SHA256_DIGEST_LENGTH];

SHA256((unsigned char*)dataToSign.c_str(), dataToSign.size(), hash);

// Read the private key

FILE* keyFile = fopen(privateKeyPath.c_str(), "r");

RSA* rsaPrivateKey = PEM_read_RSAPrivateKey(keyFile, nullptr, nullptr, nullptr);

fclose(keyFile);

// Sign the hash

unsigned char* signatureBuffer = new unsigned char[RSA_size(rsaPrivateKey)];

unsigned int signatureLength;

RSA_sign(NID_sha256, hash, SHA256_DIGEST_LENGTH, signatureBuffer, &signatureLength, rsaPrivateKey);

signature = std::string((char*)signatureBuffer, signatureLength);

delete[] signatureBuffer;

RSA_free(rsaPrivateKey);

}

};

Code language: C++ (cpp)Verifying Signatures

We now need to verify that the transaction was signed by the sender’s private key using their public key.

bool verifyTransaction(const Transaction& txn, std::string publicKeyPath) {

std::string dataToVerify = txn.sender + txn.recipient + std::to_string(txn.amount);

// Generate SHA256 hash of the data

unsigned char hash[SHA256_DIGEST_LENGTH];

SHA256((unsigned char*)dataToVerify.c_str(), dataToVerify.size(), hash);

// Read the public key

FILE* keyFile = fopen(publicKeyPath.c_str(), "r");

RSA* rsaPublicKey = PEM_read_RSA_PUBKEY(keyFile, nullptr, nullptr, nullptr);

fclose(keyFile);

// Verify the signature

bool isValid = RSA_verify(NID_sha256, hash, SHA256_DIGEST_LENGTH,

(unsigned char*)txn.signature.c_str(), txn.signature.size(), rsaPublicKey);

RSA_free(rsaPublicKey);

return isValid;

}

Code language: C++ (cpp)4.4 Verifying Data Integrity

Each block in the blockchain stores its data hash, which is calculated using SHA-256. By comparing the stored hash with the recalculated hash, nodes can detect tampering.

Example of Data Integrity Check

bool isBlockValid(const Block& block) {

return block.hash == block.calculateHash();

}

Code language: C++ (cpp)4.5 Enhancing Security with Multi-Signatures

Multi-signature (multisig) transactions require multiple parties to sign before the transaction is considered valid. This adds an extra layer of security.

Benefits of Multi-Signature

- Increased Security: Prevents a single point of failure.

- Joint Ownership: Enables shared control over a single account or wallet.

4.6 Summary

In this section, we implemented cryptographic techniques to secure transactions and ensure data integrity in our blockchain:

- Public-Key Cryptography for signing and verifying transactions.

- Hash Functions for verifying the integrity of block data.

- Digital Signatures to ensure non-repudiation.

Section 5: Networking and Decentralization

Building a blockchain is more than just a chain of blocks secured by cryptographic principles. The true power of blockchain technology lies in its decentralized and distributed nature. In this section, we will focus on:

- Understanding the importance of decentralization in blockchains.

- Exploring peer-to-peer (P2P) networking, which is the foundation of decentralized systems.

- Implementing a simple P2P network using sockets in C++.

- Achieving consensus across the distributed network.

- Handling network communication, broadcasting, and synchronization of the blockchain across nodes.

5.1 The Importance of Decentralization

Decentralization is the key characteristic that distinguishes blockchain from traditional databases. Unlike centralized systems that rely on a single authority, decentralized blockchains are maintained by a distributed network of nodes, each holding a copy of the entire blockchain.

Benefits of Decentralization

- Fault Tolerance:

Since no single entity controls the network, it is resilient to failures or attacks on individual nodes. - Censorship Resistance:

Decentralization ensures that no central authority can censor or alter the blockchain data. - Trustless Environment:

Users do not need to trust a single entity. The network achieves consensus through cryptographic algorithms and economic incentives. - Improved Security:

Decentralized networks are harder to attack because compromising a majority of nodes is computationally expensive.

5.2 Peer-to-Peer Networking

A Peer-to-Peer (P2P) Network is a decentralized communication model in which each participant (node) can act as both a client and a server. In blockchain networks, nodes communicate directly with each other to propagate transactions and new blocks.

How P2P Networks Work

- Node Discovery:

Nodes discover and connect to other nodes in the network. - Message Propagation:

Messages, such as new transactions or mined blocks, are propagated throughout the network. - Consensus:

Nodes reach a consensus on the state of the blockchain by following predefined protocols. - Synchronization:

Each node maintains a local copy of the blockchain and synchronizes it with other nodes.

5.3 Implementing a P2P Network in C++

We will implement a basic P2P network using sockets in C++. This implementation will include the following components:

- A Node class to represent individual nodes in the network.

- A Server to listen for incoming connections and handle communication.

- A Client to connect to other nodes and send messages.

- A Network Protocol to define message types and handling.

Setting Up Sockets

C++ provides several libraries for socket programming, including the native POSIX sockets and libraries like Boost.Asio. For simplicity, we’ll use POSIX sockets.

Server Setup

The server listens for incoming connections from other nodes.

#include <iostream>

#include <string>

#include <sys/socket.h>

#include <netinet/in.h>

#include <unistd.h>

class Server {

public:

int serverSocket;

int port;

Server(int port) : port(port) {}

void start() {

serverSocket = socket(AF_INET, SOCK_STREAM, 0);

if (serverSocket < 0) {

std::cerr << "Error creating socket." << std::endl;

return;

}

sockaddr_in serverAddr{};

serverAddr.sin_family = AF_INET;

serverAddr.sin_addr.s_addr = INADDR_ANY;

serverAddr.sin_port = htons(port);

if (bind(serverSocket, (struct sockaddr*)&serverAddr, sizeof(serverAddr)) < 0) {

std::cerr << "Error binding socket." << std::endl;

return;

}

listen(serverSocket, 5);

std::cout << "Server listening on port " << port << "..." << std::endl;

while (true) {

sockaddr_in clientAddr;

socklen_t clientLen = sizeof(clientAddr);

int clientSocket = accept(serverSocket, (struct sockaddr*)& clientAddr, &clientLen);

if (clientSocket >= 0) {

handleClient(clientSocket);

}

}

}

private:

void handleClient(int clientSocket) {

char buffer[1024];

read(clientSocket, buffer, sizeof(buffer));

std::cout << "Received message: " << buffer << std::endl;

close(clientSocket);

}

};

Code language: C++ (cpp)Client Setup

The client connects to a server node and sends a message.

#include <iostream>

#include <string>

#include <sys/socket.h>

#include <arpa/inet.h>

#include <unistd.h>

class Client {

public:

std::string serverIP;

int serverPort;

Client(std::string ip, int port) : serverIP(ip), serverPort(port) {}

void sendMessage(std::string message) {

int clientSocket = socket(AF_INET, SOCK_STREAM, 0);

if (clientSocket < 0) {

std::cerr << "Error creating socket." << std::endl;

return;

}

sockaddr_in serverAddr{};

serverAddr.sin_family = AF_INET;

serverAddr.sin_port = htons(serverPort);

inet_pton(AF_INET, serverIP.c_str(), &serverAddr.sin_addr);

if (connect(clientSocket, (struct sockaddr*)&serverAddr, sizeof(serverAddr)) < 0) {

std::cerr << "Connection failed." << std::endl;

return;

}

send(clientSocket, message.c_str(), message.size(), 0);

close(clientSocket);

}

};

Code language: C++ (cpp)5.4 Network Protocol

A simple blockchain network requires a protocol to handle communication between nodes. The protocol defines:

- Message Types: For example,

NEW_TRANSACTION,NEW_BLOCK, andREQUEST_BLOCKCHAIN. - Message Format: The structure of each message (e.g., JSON or custom binary format).

Defining Message Types

enum MessageType {

NEW_TRANSACTION,

NEW_BLOCK,

REQUEST_BLOCKCHAIN

};

Code language: C++ (cpp)Sending and Receiving Messages

We can use a simple JSON format to send messages between nodes.

#include <nlohmann/json.hpp>

using json = nlohmann::json;

std::string createNewTransactionMessage(const std::string& sender, const std::string& recipient, double amount) {

json message;

message["type"] = NEW_TRANSACTION;

message["sender"] = sender;

message["recipient"] = recipient;

message["amount"] = amount;

return message.dump();

}

Code language: C++ (cpp)5.5 Synchronizing the Blockchain

When a new node joins the network, it needs to synchronize its blockchain with other nodes.

Requesting the Blockchain

The new node sends a REQUEST_BLOCKCHAIN message to a peer, which responds with its current blockchain.

Updating the Local Blockchain

The node compares the received blockchain with its own and updates if the received blockchain is longer and valid.

void synchronizeBlockchain(const std::vector<Block>& receivedChain) {

if (receivedChain.size() > blockchain.size() && isValidChain(receivedChain)) {

blockchain = receivedChain;

std::cout << "Blockchain synchronized." << std::endl;

}

}

Code language: C++ (cpp)5.6 Achieving Consensus

Consensus ensures that all nodes agree on a single version of the blockchain. Common consensus algorithms include:

- Longest Chain Rule: The valid chain with the most accumulated proof of work is accepted.

- Proof of Stake (PoS): Nodes with higher stakes have a higher probability of adding blocks.

5.7 Summary

In this section, we have built a simple P2P network for our blockchain, focusing on:

- The importance of decentralization.

- Implementing server and client nodes using sockets.

- Designing a network protocol for communication.

- Synchronizing the blockchain across nodes.

- Achieving consensus in a distributed environment.

In the next section, Section 6: Enhancing Blockchain Security and Implementing Advanced Features, we will focus on advanced features such as smart contracts, scalability solutions, and additional security measures to make the blockchain production-ready.

Section 6: Enhancing Blockchain Security and Implementing Advanced Features

A basic blockchain provides the foundational components of a distributed ledger, but real-world applications demand enhanced security, scalability, and additional features. In this section, we will focus on elevating our blockchain by:

- Implementing Advanced Security Measures to safeguard against sophisticated attacks.

- Integrating Smart Contracts for automated and trustless execution of agreements.

- Enhancing Scalability to support a growing network of nodes and transactions.

- Adding a Consensus Mechanism to achieve decentralized agreement on block validity.

- Optimizing Network Performance for efficient communication and synchronization.

- Ensuring Data Privacy while maintaining transparency in the blockchain.

6.1 Advanced Security Measures

Blockchain security is a critical aspect, especially when handling financial transactions or sensitive data. Let’s examine some common vulnerabilities and how to mitigate them.

Common Security Threats

- 51% Attack:

In a Proof-of-Work (PoW) blockchain, if an attacker controls more than 50% of the network’s mining power, they can double-spend and censor transactions. Mitigation:- Increase network decentralization.

- Use Proof-of-Stake (PoS) or hybrid consensus mechanisms to reduce the attack’s feasibility.

- Sybil Attack:

An attacker creates multiple fake nodes to gain control over the network. Mitigation:- Implement a reputation system.

- Use identity verification or proof of identity mechanisms.

- Man-in-the-Middle (MITM) Attack:

An attacker intercepts and modifies messages between nodes. Mitigation:- Encrypt network communication using TLS (Transport Layer Security).

- Authenticate nodes using digital certificates.

Implementing Secure Network Communication

Let’s enhance our P2P network by securing communications between nodes using TLS.

Step 1: Generating TLS Certificates

We can generate self-signed certificates using OpenSSL:

openssl req -new -x509 -keyout server.pem -out server.pem -days 365 -nodes

Code language: Bash (bash)Step 2: Updating the Server to Use TLS

#include <openssl/ssl.h>

#include <openssl/err.h>

class SecureServer {

public:

int port;

SSL_CTX* ctx;

SecureServer(int port) : port(port) {

SSL_load_error_strings();

OpenSSL_add_ssl_algorithms();

ctx = SSL_CTX_new(SSLv23_server_method());

if (!SSL_CTX_use_certificate_file(ctx, "server.pem", SSL_FILETYPE_PEM) ||

!SSL_CTX_use_PrivateKey_file(ctx, "server.pem", SSL_FILETYPE_PEM)) {

ERR_print_errors_fp(stderr);

exit(EXIT_FAILURE);

}

}

void start() {

int serverSocket = socket(AF_INET, SOCK_STREAM, 0);

sockaddr_in serverAddr{};

serverAddr.sin_family = AF_INET;

serverAddr.sin_addr.s_addr = INADDR_ANY;

serverAddr.sin_port = htons(port);

bind(serverSocket, (struct sockaddr*)& serverAddr, sizeof(serverAddr));

listen(serverSocket, 5);

while (true) {

int clientSocket = accept(serverSocket, nullptr, nullptr);

SSL* ssl = SSL_new(ctx);

SSL_set_fd(ssl, clientSocket);

if (SSL_accept(ssl) <= 0) {

ERR_print_errors_fp(stderr);

} else {

handleClient(ssl);

}

SSL_shutdown(ssl);

SSL_free(ssl);

close(clientSocket);

}

}

private:

void handleClient(SSL* ssl) {

char buffer[1024];

SSL_read(ssl, buffer, sizeof(buffer));

std::cout << "Secure Message Received: " << buffer << std::endl;

}

};

Code language: C++ (cpp)6.2 Integrating Smart Contracts

Smart contracts are self-executing programs that run on the blockchain. They facilitate trustless agreements between parties.

What Are Smart Contracts?

Smart contracts are written in high-level languages like Solidity (for Ethereum) or C++ (for EOS). They execute automatically when predefined conditions are met.

Use Cases for Smart Contracts

- Decentralized Finance (DeFi):

Automated lending, borrowing, and trading of cryptocurrencies. - Supply Chain Management:

Track goods and enforce agreements between suppliers and vendors. - Voting Systems:

Transparent and tamper-proof voting mechanisms.

Implementing a Simple Smart Contract in C++

Let’s implement a basic smart contract that manages a simple token system.

class SmartContract {

public:

std::map<std::string, int> balances;

SmartContract() {

balances["creator"] = 1000; // Initial token allocation

}

bool transferTokens(const std::string& from, const std::string& to, int amount) {

if (balances[from] < amount) {

std::cerr << "Insufficient balance." << std::endl;

return false;

}

balances[from] -= amount;

balances[to] += amount;

return true;

}

int getBalance(const std::string& account) {

return balances[account];

}

};

Code language: C++ (cpp)6.3 Enhancing Scalability

As the blockchain grows, scalability becomes a challenge. Solutions include:

Layer 2 Solutions

Layer 2 solutions, such as Lightning Network, handle transactions off-chain and settle on-chain only when necessary.

Sharding

Sharding divides the blockchain into smaller partitions (shards) that process transactions independently.

6.4 Achieving Consensus

Consensus algorithms ensure network-wide agreement on the blockchain state.

Proof of Work (PoW)

Nodes solve computational puzzles to validate blocks.

class ProofOfWork {

public:

int difficulty;

ProofOfWork(int difficulty) : difficulty(difficulty) {}

std::string mineBlock(Block& block) {

std::string target(difficulty, '0');

while (block.hash.substr(0, difficulty) != target) {

block.nonce++;

block.hash = block.calculateHash();

}

return block.hash;

}

};

Code language: C++ (cpp)6.5 Optimizing Network Performance

Network optimization is essential for fast and reliable communication.

Implementing a Message Queue

A message queue can manage incoming and outgoing messages efficiently.

6.6 Ensuring Data Privacy

Although blockchain is transparent, certain applications require privacy.

Zero-Knowledge Proofs (ZKPs)

ZKPs allow one party to prove knowledge of information without revealing it.

6.7 Summary

In this section, we enhanced our blockchain with:

- Advanced security measures like TLS and Sybil resistance.

- Smart contracts for automated agreements.

- Scalability solutions like sharding and Layer 2.

- Consensus mechanisms to maintain network integrity.

- Network optimizations for performance and data privacy solutions.

In the next section, Section 7: Testing, Deployment, and Maintenance, we will focus on testing the blockchain, deploying it in a production environment, and maintaining it for long-term use.

Section 7: Testing, Deployment, and Maintenance

Building a blockchain from scratch is a complex process, but the work doesn’t end with development. For a blockchain to be reliable and useful in real-world scenarios, it must be rigorously tested, carefully deployed, and consistently maintained. This section will guide you through the following key phases:

- Unit Testing and Integration Testing:

Verifying the correctness of individual components and their interactions. - Performance Testing:

Ensuring the blockchain can handle high loads and scale efficiently. - Security Testing:

Identifying and mitigating vulnerabilities in the code and network. - Deployment Strategies:

Launching the blockchain network in a live environment. - Monitoring and Maintenance:

Continuously monitoring the network, updating the system, and handling incidents.

7.1 Unit Testing and Integration Testing

Testing is a crucial step in ensuring that the blockchain behaves as expected. We’ll begin by writing unit tests for individual components such as blocks, transactions, and consensus mechanisms, and then move on to integration tests to verify how these components interact.

Setting Up a Testing Framework

For C++ projects, popular testing frameworks include Google Test (gTest) and Catch2. We’ll use Catch2 for its simplicity and ease of integration.

Installing Catch2

You can install Catch2 via a package manager like vcpkg or by adding it directly to your project:

vcpkg install catch2

Code language: Bash (bash)Writing Unit Tests for the Blockchain

Let’s write unit tests to validate the functionality of the Block and Blockchain classes.

#define CATCH_CONFIG_MAIN

#include <catch2/catch.hpp>

#include "Block.h"

#include "Blockchain.h"

TEST_CASE("Block Hash Calculation", "[block]") {

Block block(0, "Genesis Block", "0");

REQUIRE(block.calculateHash() == block.hash);

}

TEST_CASE("Adding a New Block", "[blockchain]") {

Blockchain blockchain;

Block newBlock(1, "Test Block", blockchain.getLatestBlock().hash);

blockchain.addBlock(newBlock);

REQUIRE(blockchain.getLatestBlock().data == "Test Block");

}

Code language: C++ (cpp)Writing Integration Tests

Integration tests ensure that different components work together correctly.

TEST_CASE("Blockchain Integrity", "[integration]") {

Blockchain blockchain;

blockchain.addBlock(Block(1, "Block 1", blockchain.getLatestBlock().hash));

blockchain.addBlock(Block(2, "Block 2", blockchain.getLatestBlock().hash));

REQUIRE(blockchain.isChainValid() == true);

}

Code language: C++ (cpp)7.2 Performance Testing

Performance testing evaluates the blockchain’s ability to handle large volumes of transactions and maintain low latency.

Load Testing

Simulate high transaction volumes to measure the blockchain’s performance under stress.

Load Test Script (C++)

#include <thread>

#include "Blockchain.h"

void simulateTransactions(Blockchain& blockchain, int numTransactions) {

for (int i = 0; i < numTransactions; i++) {

std::string data = "Transaction " + std::to_string(i);

blockchain.addBlock(Block(i + 1, data, blockchain.getLatestBlock().hash));

}

}

int main() {

Blockchain blockchain;

const int numThreads = 4;

const int transactionsPerThread = 1000;

std::vector<std::thread> threads;

for (int i = 0; i < numThreads; i++) {

threads.emplace_back(simulateTransactions, std::ref(blockchain), transactionsPerThread);

}

for (auto& thread : threads) {

thread.join();

}

std::cout << "Load test completed." << std::endl;

return 0;

}

Code language: C++ (cpp)Analyzing Performance Metrics

Measure the following metrics during load testing:

- Transaction Throughput: Number of transactions processed per second.

- Block Propagation Time: Time taken for a new block to propagate across the network.

- Latency: Time taken for a transaction to be confirmed.

7.3 Security Testing

Security testing is essential to protect the blockchain from attacks.

Penetration Testing

Simulate attacks to identify vulnerabilities.

Fuzz Testing

Fuzz testing involves providing random, invalid, or unexpected data as inputs to the blockchain to discover potential crashes or security issues.

void fuzzTestBlockchain(Blockchain& blockchain) {

std::string randomData = "RANDOM_" + std::to_string(rand());

blockchain.addBlock(Block(1, randomData, blockchain.getLatestBlock().hash));

}

Code language: C++ (cpp)Code Audits

Perform code audits to review the blockchain codebase for security flaws and best practices.

7.4 Deployment Strategies

Deploying a blockchain requires careful planning to ensure a smooth launch.

Choosing a Deployment Environment

You can deploy the blockchain on:

- Public Cloud: AWS, Google Cloud, Azure.

- Private Cloud: For enterprise applications.

- On-Premises: For maximum control and security.

Deploying Nodes

Deploy multiple nodes across different geographic regions to ensure decentralization and fault tolerance.

Automating Node Deployment with Docker

FROM ubuntu:20.04

RUN apt-get update && apt-get install -y build-essential

COPY ./blockchain /usr/local/bin/blockchain

ENTRYPOINT ["blockchain"]

Code language: Bash (bash)Initializing the Blockchain

Create a genesis block and configure initial nodes.

7.5 Monitoring and Maintenance

Continuous monitoring and maintenance are essential for the long-term success of a blockchain network.

Monitoring Tools

Use monitoring tools like Prometheus and Grafana to track:

- Node uptime and health.

- Transaction throughput and latency.

- Memory and CPU usage.

Implementing Alerting

Set up alerts for critical events such as:

- Node failures.

- High latency or low throughput.

- Security breaches.

Regular Updates and Bug Fixes

Maintain the blockchain by:

- Fixing bugs and vulnerabilities.

- Implementing new features and optimizations.

- Keeping dependencies and libraries up to date.

7.6 Backup and Disaster Recovery

Establish a robust backup and disaster recovery plan to minimize downtime and data loss.

7.7 Summary

In this section, we covered:

- Writing unit and integration tests to verify blockchain functionality.

- Conducting performance and security testing to ensure reliability.

- Deploying the blockchain network in a live environment.

- Monitoring and maintaining the network for long-term success.

Section 8: Conclusion and Future Enhancements

Building a blockchain from scratch in C++ is no small feat. Throughout this project, we’ve explored the fundamental concepts of blockchain technology, implemented core components, enhanced the system with advanced features, and deployed it in a real-world environment. This journey not only demystifies blockchain development but also showcases the immense potential this technology holds for reshaping industries beyond cryptocurrencies.

In this final section, we’ll:

- Summarize the development process, highlighting key takeaways.

- Discuss real-world applications and challenges of blockchain technology.

- Explore potential future enhancements to make the blockchain more robust, scalable, and secure.

- Offer insights into the evolving landscape of blockchain development and how you can continue to innovate.

8.1 Summary of the Development Process

The journey of building a blockchain from scratch can be divided into several key phases, each with its own set of challenges and learning experiences.

Phase 1: Understanding the Basics

The first step was to understand the fundamental principles of blockchain technology:

- Decentralization: The distributed nature of blockchain eliminates the need for a central authority, ensuring transparency and security.

- Immutability: Once a block is added to the chain, it cannot be altered without altering all subsequent blocks.

- Consensus Mechanisms: These ensure that all nodes in the network agree on the state of the blockchain.

We also explored how blockchain differs from traditional databases in terms of structure, security, and use cases.

Phase 2: Designing the Blockchain

The design phase involved creating the core components of our blockchain:

- Block Structure: Each block contains essential data such as the index, timestamp, transaction data, previous block hash, and its own hash.

- Blockchain Class: This manages the chain of blocks and ensures that each block is linked correctly to its predecessor.

- Proof of Work (PoW): We implemented a simple PoW algorithm to ensure that adding a new block requires computational effort, thereby securing the network.

Phase 3: Implementing the Blockchain

In this phase, we wrote the C++ code to implement our blockchain:

- Block Class: Defined the structure and methods for creating and hashing blocks.

- Blockchain Class: Managed the chain, added new blocks, and validated the integrity of the chain.

- Peer-to-Peer Network: Implemented a simple P2P network for nodes to communicate and synchronize the blockchain.

Phase 4: Enhancing the Blockchain

Once the basic blockchain was functional, we enhanced it with additional features:

- Secure Communication: Used TLS to encrypt data exchanged between nodes.

- Smart Contracts: Integrated simple smart contracts to enable automated transactions and agreements.

- Scalability: Explored techniques like sharding and Layer 2 solutions to improve the blockchain’s scalability.

- Consensus Mechanisms: Implemented different consensus algorithms, such as Proof of Stake (PoS), to improve efficiency and reduce energy consumption.

Phase 5: Testing and Deployment

Finally, we rigorously tested the blockchain to ensure its reliability and deployed it in a live environment:

- Unit and Integration Testing: Verified the correctness of individual components and their interactions.

- Performance Testing: Assessed the blockchain’s ability to handle high transaction volumes.

- Security Testing: Identified and mitigated potential vulnerabilities.

8.2 Real-World Applications of Blockchain

Blockchain technology has already transformed several industries, and its potential applications are vast and varied. Let’s explore some real-world use cases:

Financial Services

One of the earliest and most impactful applications of blockchain is in the financial sector:

- Cryptocurrencies: Bitcoin, Ethereum, and other cryptocurrencies provide decentralized alternatives to traditional currencies.

- Decentralized Finance (DeFi): Platforms like Uniswap and Aave enable users to lend, borrow, and trade assets without intermediaries.

- Cross-Border Payments: Blockchain reduces the time and cost of international transactions by eliminating intermediaries.

Supply Chain Management

Blockchain enhances transparency and traceability in supply chains:

- Provenance Tracking: Companies can track the origin and journey of goods, ensuring authenticity and quality.

- Smart Contracts: Automate supply chain processes, such as triggering payments upon delivery.

Healthcare

In healthcare, blockchain improves data security and interoperability:

- Electronic Health Records (EHRs): Patients can control access to their medical records, ensuring privacy and security.

- Clinical Trials: Blockchain provides a transparent and tamper-proof record of trial data, enhancing trust in research outcomes.

Voting Systems

Blockchain can improve the integrity of voting systems:

- Tamper-Proof Voting: Voter records and ballots are securely stored on the blockchain, reducing the risk of fraud.

- Transparency: Results are transparent and verifiable by all participants.

Intellectual Property

Blockchain can protect intellectual property rights and facilitate royalty payments:

- Digital Rights Management: Creators can register their works on the blockchain, proving ownership and managing licensing agreements.

- Micropayments: Smart contracts enable automated royalty payments based on usage.

8.3 Challenges of Blockchain Technology

Despite its potential, blockchain technology faces several challenges that must be addressed to achieve widespread adoption.

Scalability

As the blockchain grows, the time and resources required to process transactions increase. Solutions like sharding and Layer 2 networks help, but scalability remains a challenge.

Energy Consumption

Proof of Work (PoW) blockchains consume significant amounts of energy. Transitioning to more energy-efficient consensus mechanisms, such as Proof of Stake (PoS), can mitigate this issue.

Regulatory Uncertainty

The regulatory landscape for blockchain and cryptocurrencies is still evolving. Companies must navigate complex and sometimes conflicting regulations in different jurisdictions.

Privacy

While blockchain offers transparency, certain applications require privacy. Solutions like Zero-Knowledge Proofs (ZKPs) and confidential transactions can provide privacy without sacrificing transparency.

8.4 Future Enhancements for Our Blockchain

Our blockchain is a functional prototype, but there are several enhancements we can implement to make it more robust, scalable, and secure.

Advanced Consensus Mechanisms

Exploring advanced consensus mechanisms can improve the blockchain’s efficiency and security:

- Delegated Proof of Stake (DPoS): A variation of PoS where stakeholders elect delegates to validate transactions.

- Byzantine Fault Tolerance (BFT): A consensus algorithm that tolerates faulty or malicious nodes.

Interoperability

Future blockchains should be able to communicate and interact with other blockchains and traditional systems:

- Cross-Chain Communication: Enable seamless asset transfers and data sharing between different blockchains.

- Interoperability Protocols: Implement standards like Polkadot or Cosmos for cross-chain communication.

Decentralized Identity

Decentralized identity solutions give users control over their digital identities:

- Self-Sovereign Identity (SSI): Users own and manage their identities without relying on centralized authorities.

- Verifiable Credentials: Enable secure and verifiable digital identities for online services.

Artificial Intelligence (AI) Integration

Integrating AI with blockchain can unlock new possibilities:

- Smart Contract Automation: Use AI to optimize and automate smart contract execution.

- Fraud Detection: AI can analyze blockchain data to detect fraudulent activities in real-time.

Quantum-Resistant Cryptography

As quantum computers become more powerful, they could threaten current cryptographic algorithms. Implementing quantum-resistant algorithms will future-proof the blockchain.

Conclusion

Building a blockchain from scratch in C++ has been an enriching journey. We’ve gained a deep understanding of the underlying principles, faced and overcome technical challenges, and explored the vast potential of blockchain technology. This project serves as a foundation for further exploration and innovation in the field.

As blockchain technology continues to evolve, so too will its applications and challenges. By staying informed, continuously learning, and embracing new ideas, you can contribute to shaping the future of decentralized systems and unlock new possibilities for innovation and growth.

Whether you’re a developer, entrepreneur, or enthusiast, the future of blockchain is yours to shape. Let’s continue to innovate, build, and create a decentralized future that empowers individuals and transforms industries worldwide.